housing allowance for pastors fannie mae

The housing allowance may be added to income but may not be used to offset the monthly housing payment. Many mortgage lenders apply a gross up factor of 25 percent when a housing allowance is also tax-exempt.

Pastoral Housing Allowance for 2021.

. A minister who receives a housing allowance may exclude the allowance from gross income to the extent its used to pay expenses in providing a home. It is important to remember that you are only allowed to claim a housing allowance of the lesser of. According to tax law if you are planning to claim a housing allowance deduction actually an exclusion for the upcoming calendar year your Session is required to designate the specific amount to be paid to you as housing allowance prior to the.

The amount excluded cant be more than reasonable compensation for. Speak to a subject matter expert at the IRS. Is the housing allowance also excluded from earnings subject to self-employment taxes.

Only expenses incurred after the allowance is officially designated can qualify for tax exemption. The largest benefit of the income is that it is nontaxable income. What is a housing allowance.

Housing or parsonage income may be considered qualifying income if there is documentation that the income has been received for the most recent 12 months and the allowance is likely to continue for the next three years. These allow ministers of the gospel to exempt all of their housing expenses from federal income taxes. That means that if you only work ten hours a week at the church then you cannot claim a 50000 housing allowance.

Therefore it is important to request your housing allowance and have it designated before January 1 so that it is in place for all of 2020. It is commonly recommended to include an extra 10 when you request your housing allowance in order to cover unforseen expenses. The housing allowance exclusion only applies for federalincome tax purposes.

Section 107 of the Internal Revenue Code allows ministers of the gospelto exclude some or all of their ministerial income designated by their church or church-. The housing allowance may be added to income but may not be used to offset the monthly housing payment. One of the greatest financial benefits available to pastors is the housing allowance exemption.

Section 107 of the Internal Revenue Code IRC states that. The ministers housing allowance is the most important tax ben-efit available to ministers. Anonymous in N C You have several questions going here but basically the answers are that church employed Senior Pastors and Associate Pastors are treated the same if they meet the 5 question criteria set up by IRS.

Fannie Maes underwriting guidelines emphasize the continuity of a borrowers stable income. If you receive as part of your salary for services as a minister an amount officially designated in advance of payment as a housing allowance and the amount isnt more than. For information on military housing refer to B3-31-03 Base Pay Salary or Hourly Bonus and Overtime Income.

What is a Clergy Housing Allowance. Individuals who change jobs frequently but who are nevertheless able to earn consistent and predictable income are also considered to have a reliable flow. In that case at most 5000 of the 10000 housing allowance can be excluded from the pastors gross income in that calendar year.

Get the IRS to issue a private letter ruling regarding your specific situation. This requirement does not apply to military quarters allowance. A housing allowance is often a common and critical portion of income for pastors.

Regretfully the clergy has a difficult time getting qualified for a mortgage loan. By Amy Monday July 29 2019. The ministers cash housing allowance and parsonage allowance.

A housing allowance is an annual amount of compensation that is set aside by the church to cover the cost of housing related expenses for its ministers. The housing allowance may be added to income but may not be used to offset the monthly housing payment. For example in mortgage lending a 1000.

This comes in two forms. A ministers housing allowance sometimes called a parsonage allowance or a rental allowance is excludable from gross income for income tax purposes but not for self-employment tax purposes. It is time again to make sure you update your housing allowance resolution.

This requirement does not apply to military quarters allowance. The amount actually used to provide or rent a home. It is a form of income to fully pay or at least offset a part of the expense to own or rent a home.

These can cost hundreds of dollars and are difficult to obtain. The housing allowance for pastors is not and can never be a retroactive benefit. The stable and reliable flow of income is a key consideration in mortgage loan underwriting.

How To Determine What Qualifies For The Clergy Housing Allowance. To do so request this amount. It is a form of income to fully pay or at least allow a part of the expense to own or rent a home.

Housing allowance for pastors fannie mae Tuesday March 8 2022 Edit. I dont think the IRS would consider 100 an hour reasonable compensation for your service. There are only three ways to find out for sure if something qualifies.

The same goes for a housing allowance paid to ministers that own or rent their homes. Generally those expenses include rent mortgage interest utilities and other expenses directly relating to providing a home. Housing Allowance for Pastors.

A housing allowance is often a common and critical portion of pastoral income. The amount spent on housing reduces a qualifying ministers federal and state income tax burden. Pastoral Housing Allowance Using Nontaxable Income To Buy A Home How Much Housing Allowance Can A Pastor Claim The Pastor S Wallet Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages Mortgage Lenders Mortgage Kentucky.

Your housing allowance is also limited to an amount that represents reasonable pay for your ministerial services. The eligible housing allowance amount is exempt from federal income taxes but not from self-employment taxes Social Security and medicare unless a minister has filed a Form 4361 and been approved to opt out of social security. The housing allowance may be added to income but may not be used to offset the monthly housing paymentNote.

Associate Pastors and Housing Allowance by.

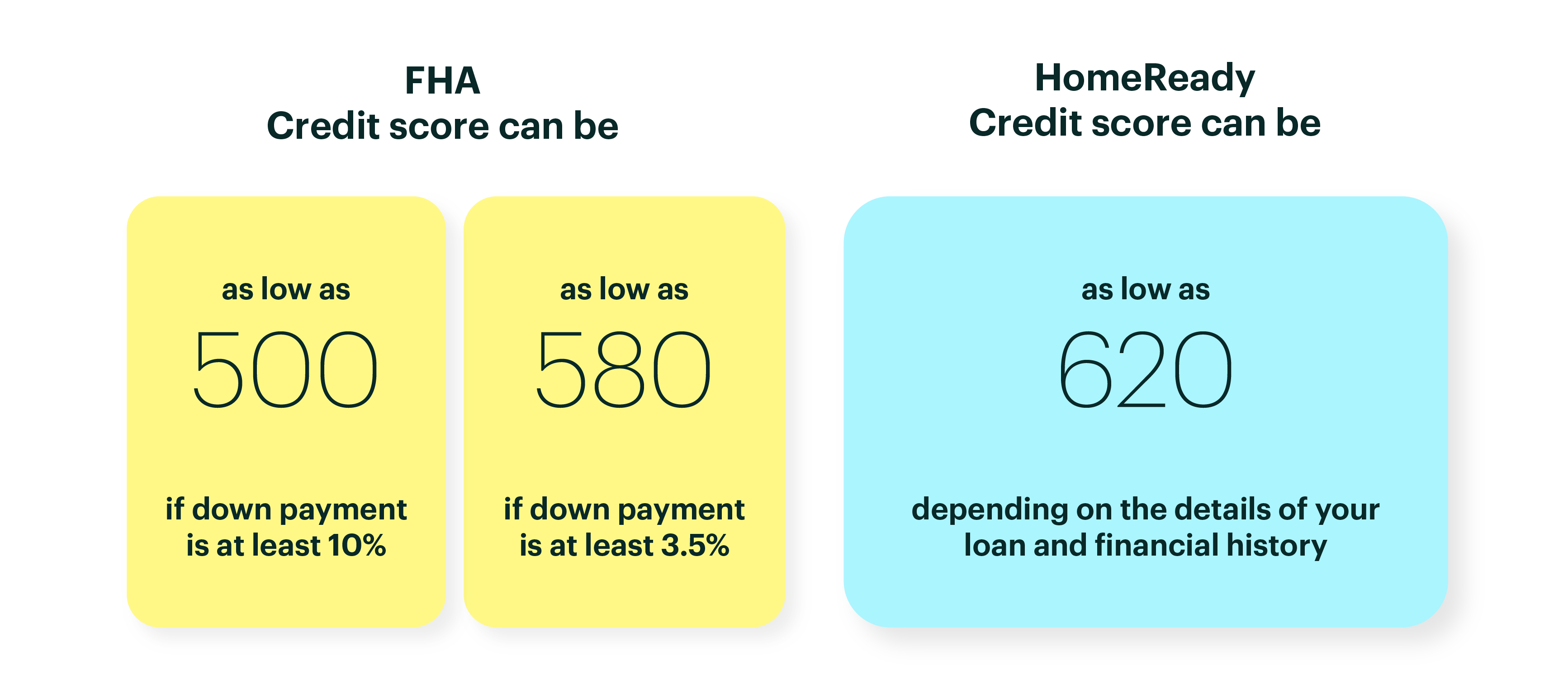

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages We Ve Dropped Our Minimum Fico Score To 620 For Kentucky Mortgage Loan Approvals

How Much Housing Allowance Can A Pastor Claim The Pastor S Wallet

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages Effective On 9 18 21 Fannie Mae Announced That Their Automated Underwriting System Will Now Take An Average Of The

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages Effective On 9 18 21 Fannie Mae Announced That Their Automated Underwriting System Will Now Take An Average Of The

Do Pastors Pay Social Security And Medicare The Pastor S Wallet

Learn About Trid Nfm Lending Mortgage Loans Va Mortgage Loans Mortgage Help

How Much Housing Allowance Can A Pastor Claim The Pastor S Wallet

How Do Pastors Clergy Or Ministers Qualify For A Usda Loan Usda Loan Pro

How Much Housing Allowance Can A Pastor Claim The Pastor S Wallet

How Do Pastors Clergy Or Ministers Qualify For A Usda Loan Usda Loan Pro

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages Fannie Mae

Using A Pastors Minister S Housing Allowance To Qualify For A Mortgage Loan

How Much Housing Allowance Can A Pastor Claim The Pastor S Wallet

Pastoral Housing Allowance Using Nontaxable Income To Buy A Home

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages Fannie Mae

How Much Housing Allowance Can A Pastor Claim The Pastor S Wallet